THE ULTIMATE GUIDE: NFT CHEAT SHEET

By Sharon Weisman, CEO, PowerStation Studios US

“You tried ignoring this ‘NFT Nonsense’ for as long as you possibly could. I can’t blame you.

But at this point, it’s best to join the conversation because you’re a licensing professional – and who better than you to recognize new ways to monetize ownership and fandom?”

Sure, this is all blowing up at the speed of light, but gambling is in our DNA, and we are never afraid to put our chips on something that might ensure we can create new revenue streams for brands.

PowerStation Studios created a basic Licensing Cheat Sheet to help us all navigate the NFT space. The more we collectively work and support each other now, the more innovation and regulation there will be.

The irony is that NFTs projects are based on the same consumer behaviors we deem our merchandising strategies on: collecting, rewarding, loyalty, rarity, experiential, reveal concepts, unlocking benefits/content, exclusive access, community, sharable opportunities, tokenizing, dopamine hits, etc.

No one is reinventing the wheel, it’s just infused with tech that plays well into the human needs of ownership and authenticity.

As with any new tech, this shift brings a whole new lingo.

Hopefully, this helps you “talk the talk” before you attempt to “walk the walk.”

Ready???

Web1.0

You+screen+mouse+keyboard. It refers to the first stage of development on the World Wide Web that was characterized by simple static websites. Its when you log onto a static site, read something on a screen, leave the device and can easily go back to your offline life.

Example: “I just logged onto the CDC site for the millionth time today to see if the Covid regulations changed.”

Web2.0

You+mobile+social+cloud. When online and offline blur a little and we can build communities online, read/write and communicate with others online.Example: “I am super active on FB, especially in the Total Licensing Community page. It’s how I keep up with all the industry excitement.”

Web3.0

It’s about virtual and physical sharing the same space – the virtual is baked into the fabric of reality. Life as a hybrid in form of virtual profiles/Avatars that will enable us to further blur the worlds.

Example: “My Roblox avatar is dope, yo! I Played Adopt Me for 3 hours and traded pets with my bestie, Steven Ekstract!”.

NFT

Non-fungible token. While this sounds like ancient mushroom money, this describes an asset that is unique and cannot be traded for a like asset. The best example to understand this is traditional currency:

I can trade five $1 bills for one $5 bill. They are of equal value. I can trade a $1 for another $1 bill and they are of equal value.

A non-fungible token cannot be traded for another like asset because it is unique in design and has a singular identifying token on the Ethereium blockchain.

Example: “I might not be able to buy my favorite artist’s latest piece, but I own the NFT of it.”

SFT

Semi-fungible token. There are some NFT projects that have multiples of the same assets.

Don’t get too caught up between SFT and NFT. Unless you’re super petty, no one really distinguishes the two.

For example, if a photographer minted multiple copies of her work as an NFT. Each photo has its own unique token (identifier) on the Ethereum blockchain, but there’s nothing inherently different between copies of the photographs.

The spirit of NFTs is to put assets on a blockchain for decentralized ownership and transfer.

Blockchain

The technology powering this new wave of business and trade. In its simplest form, the use of the blockchain is to record and store information.

Information (pictures, text, video etc.) on the internet is stored in a central database on a companies server. Blockchain as the underlying process that makes cryptocurrencies possible. Specifically, NFTs are typically held on the blockchain.

Example: if you post something on Instagram, that information is stored on Meta’s server. If you deposit money into a bank then that information is stored on that bank’s server. Think “a huge file cabinet where every single file is documented – you know exactly who owns it and where it is placed.

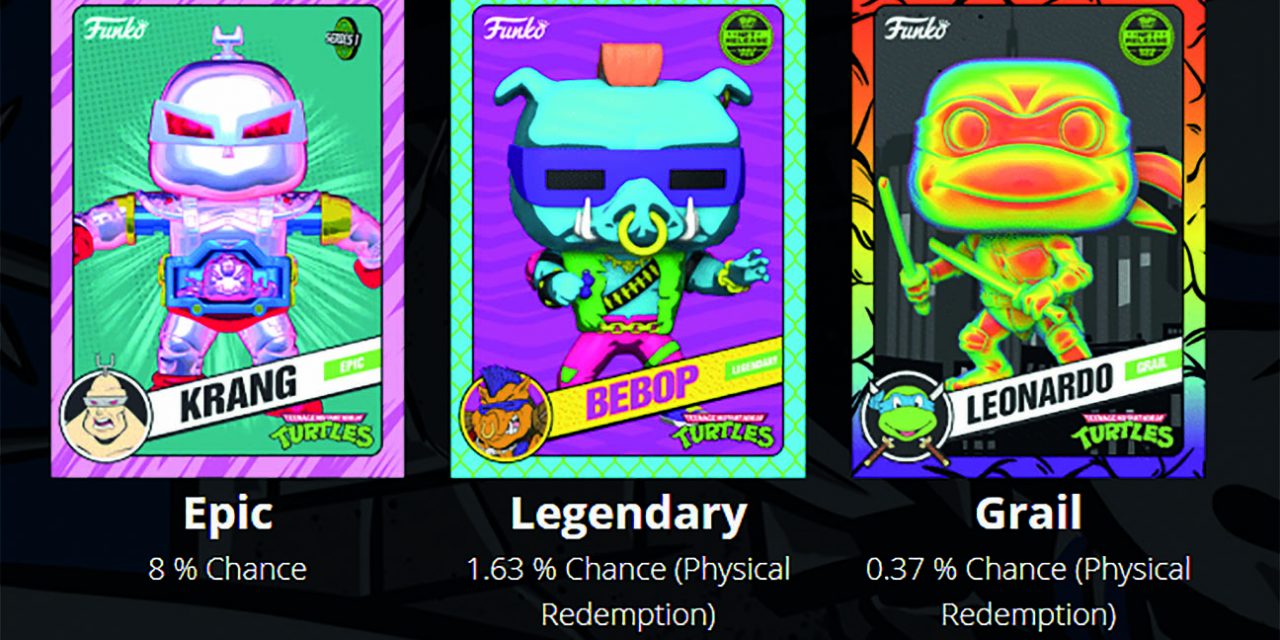

Rarity

Same with traditional trading cards, there can be logic attached to the NFT ranking. NFT rarity decides how rare an NFT is and in turn, how valuable it is. Rare NFTs are most highly sought-after by collectors, which pushes their price up.

Example: “I bet this cool NFT is worth way more than the one I have now… I will check what its value is on Rarity Sniper, it’s by far the best tool for this out there right now.”

1/1

1/1 is shorthand for ‘One of One’ (or 1×1 NFT) where there is a single token issued for a unique asset.

Trait

Many NFT projects offer a Collection of NFTs with a number of traits that interchange, making each NFT in the Collection unique. There is a logic attached to the collection so some traits are are more rare than others (or when certain traits are combined, the NFT gets bumped up a rarity level). NFTs with rare traits usually sell for more. Most projects offer blind packs for sale so you don’t know the traits you’ll get until the reveal date, making it a surprise if you got a rare one (sound familiar? Yup, you got this already).

Mint

This is the process of recording files on the blockchain (such as JPEGs and Gifs). Once a digital file/asset has been created or designed, it needs to be uploaded to the blockchain network. The term “minting” was born to name this process.

In a way, minting an NFT asset is buying it at a pre-sale price.

Minting is not only limited to NFT’s. You can mint cryptocurrencies – anything that’s recorded on the blockchain really.

ETH

Short for Ether, the crypto currency used to buy/sell NFT assets on the Ethereum blockchain.

Wallet

A digital wallet comes with private keys that ONLY the user knows. This allows users to buy, sell and store NFTs securely. The most popular wallet on Ethereum is called Metamask.

By now we get that blockchain eliminates that need for 3rd parties.

Example: An alternative way to send money to Dave Collins for the round of drinks at Eye Candy last night, you would just send crypto from your wallet to his wallet. The blockchain would record that transaction and all the details, so you can always see it happened.

Exchange/Marketplaces

If you have crypto you want to sell or if you want to buy an NFT but don’t know anyone selling it, you can use exchanges and marketplaces. Just like a traditional market, they connect buyers and sellers in a central place. Common exchanges for cryptocurrency are coinbase and binance. Common marketplaces for NFTs are opensea and rarible

Example: “I spent 0.89 ETH on an ultra rare NFT on OpenSea. Super excited about this one since it was previously owned by Peter Hollo!”

Utility

NFTs as awesome as the posters you had on your wall when we were kids.

What brings them to a whole new level is if a token (NFT/crypto) provides a wider functionality. If a digital asset (NFT) also come with utility, is means it scores its owner extra perks and benefits. These may be access to exclusive events or products, VIP Clubs, first to future products, conferences, unlocking exclusive content, etc.

Decentralization

This refers to the nature of cryptocurrency in which invertors work directly with one another as opposed to through a centralized exchange. This means the buyers and the sellers communicate, buy and sell and display ask prices all directly between on another in real-time without needing to be in the same place. For NFTs, peer-to-peer transactions on a decentralized market attempt to democratize the creators world.

Discord

It’s a social platform that started as “Social Media for Gamers,” now Discord groups are where the owners of an NFT project gather in one space, chat with each other, earn roles connected to the NFT tokens they hold, track sales bots that post messages every time a sale happens, and much more.

It really is an overwhelming waterfall of information, so make sure to subscribe to servers you are truly interested in.

Alpha

Alpha is best described as “intel”. Those who possess alpha have information that the rest of the market hasn’t found out about yet. There are people who spend hours and hours finding undiscovered projects, and sometimes, they share this on Twitter/Telegram/Discord.

NFT Archeologist

Yes, this is a real term. The people who dig up Alpha also call themselves NFT archeologists. They search every nook and cranny of the internet to find NFT projects created but not yet discovered.

Degen

Short for ‘degenerate’. It is often a term used to describe people who buy NFTs. We know that NFTs are risky, we know minting projects is like gambling, but the NFT-savvy community embraces it and call themselves degens.

Example: “Hasbro shouldn’t hire an NFT expert, they should hire an NFT degen! Someone who’s obsessed and part of the community.”

Smart Contracts

Smart Contracts are computer programs (automation) built on a blockchain. These help us to not only having a record of information on the blockchain, but we can also have automation that is executed when a predetermined condition is met.

They are pieces of code that execute agreements automatically and lay out the terms. These agreements build trust as they are stored on the blockchain and executed automatically without human intervention.

Example: “I checked the NFT Smart Contract to ensure it does what the developers say it will. These really used to be written on actual paper by expensive lawyers a couple of years ago?!”

GMI

Stands for ”Gonna Make it.”

This term is used to describe projects or collectors who are going to make it and succeed in the NFT space.

NGMI

Stands for “Not Gonna Make it.”

This term is used for people and projects that won’t last long in the NFT space.

FUD

Stands for “Fear, Uncertainty, Doubt.” This is used when someone questions the legitimacy of an NFT project. Not all FUD negative. It’s good to have questions and do your research of potential points of failure. FUD that is based on false information is frowned upon.

Example: “Isaac Larian came into a Discord channel I’m in, and started spreading FUD around the Mattel Barbie NFT project.”

Pumping

This term describes when an NFT asset is rising in price quickly.

Shill

This term describes when a person is promoting an asset they own or a project they’ve invested in. It is also a term sometimes used instead of “sell”.

Whale

A Whale is someone who has a lot of ETH and can change the market dynamic for a project by buying a lot of assets or purchasing assets at a significant price. Many projects rely on whales to get attention and social proof that it’s a good project to own.

Example: “Wait until the whales like Gary Vee find out about this project, once they do, it’s golden!”

Floor

Floor represents the lowest price available for an asset in a set. It is the minimum amount you need to buy an asset in a project. This is an important metric to look at when evaluating an NFT project.

Sweeping the Floor

Sweeping the floor indicates a whale or group of buyers who are buying every asset in an NFT project that is listed at the floor price. This action raises the floor price for an NFT project in the immediate term.

Examples: “Whales are sweeping the floor! It’s gone up from 1 ETH to 3 ETH!”

Paper Hands

Paper Hands is a term used to describe people who panic and quickly sell their NFT assets.

Diamond Hands

Diamond hands is a term used to describe people who have the guts to ride out a project over the long-term through the ups and the downs of its pricing.

Example: “The price on my NFT dropped 50% but I still believe in it. I’m not selling… I’ve got diamond hands!”

Apeing In

Apeing in simply means buying an NFT project. Sometimes it means you bought into a project heavily with a lot of ETH.

GAS (gwei)

Gas or Gas fees in their simplest form are transaction fees you have to pay in order to fulfil a contract or transaction on the ethereum blockchain.

You will have to pay a gas (=the transaction fee) when you buy an NFT.

The gas fee is used to pay the computers (AKA Miners) that keep the blockchain network up to date.

Example: “NFTs share one harmful trait with cryptocurrency: they both use a ton of energy to be generated, and omit CO2 that is harmful for the environment… but solutions are around the corner, and licensing peeps can’t even roll their eyes at this since they have “plastic fantastic” challenges of their own”.

PoP / POAP

Proof of Participation or Proof of Attendance Protocol respectively.

The equivalent of saving your concert stubs or conference badges as souvenirs or bragging opportunities IRL

A new utility emerged for NFTs of keeping an immutable record of your life experiences including virtual and in-person events. NFTs also function as an admission/access token and then function as proof you were there.

The NFT communities love this concept since other benefits of this include, beyond the obvious: more privacy, no more cumbersome mailing lists, ownership of limited edition assets, IRL bragging rights, increase of “social currency”. Example: last year, during the NFT NYC conference, Board Apes had a secret wild party for all their owners. A special NFT granted you access to the party. It was scanned and changed its color forever, which now is a proof you were an Ape OG till the end of time!”

ROADMAP

An NFT Roadmap is a document that maps out the goals and strategies of an NFT project in order to communicate its long-term value. NFT roadmaps usually include key project milestones, short and long-term goals, and plans for marketing and growth as well as community engagement.

Flex

Flex simply means to show off. People buy expensive items to “flex” to friends, family, strangers, and other collectors.

Example: read the next acronym description and I will combine the two for a serious flex.

PFPs

PFP stands for Profile Pic. With many new NFTs launching avatar projects, many use them as their profile picture on Twitter to flex their ownership.

PFPs are important in the culture of NFTs — it’s a way to show off ownership of an asset, making it desirable.

Example: “Stephen Curry just changed its PFP on Twitter to an NFT. That is a massive flex.”

Mooning

Mooning refers to an NFT project that is growing in price rapidly. It’s a sales boom. This is usually an exciting time for NFT projects. Mooning and pumping are often used interchangeably.

DAO

DAO stands for decentralized autonomous organization.

Ser

Ser has become the new noun to replace “Sir” when addressing someone. In NFTs, we welcome all genders, but this has become popular.

Ser is actually middle english for “Sir” and for whatever reason it’s caught on in the NFT community.

Example: “Are we gmi, ser?”

Fren

Fren is short for friend, often referring to someone who is active in the NFT community.

Example: “Hey fren, I see you also got a WWE John Cena NFT! WGMI.”

Staking

While staking isn’t NFT slang, it’s a good term to know. Staking is when you ‘lock up’ an NFT or coins for a certain amount of time in order to earn interest on your asset. The amount of interest paid is project-dependent. The currency in which you’re paid is usually tokens created by the NFT project. Staking is used by projects to reward holders who lock their assets up, removing sell pressure because the asset is being held for the Staking period. The time an asset is required to be locked up in Staking varies depending on the project.

Example: “I bought an NFT so I can stake it and earn tokens, it’s the best passive income strategy nowadays!”

Hodl

Hodl is a misspelling of ‘hold’ first coined on Bitcointalk.org in 2013 after a large crash in price. The term caught on and earned the acronym hold on for dear life. Crypto community members use the term to signal they’re not selling. Yup, it’s a verb too…

Example: “I bought a new NFT and I’m hodling!”

Delist

When you put an NFT for sale, you pay gas. If you want to raise the price of that NFT, you need to pay gas to delist the item in order to remove it from listings. You can’t raise the price without delisting an NFT and many times people forget to delist while a project is increasing in value.

Example: “The project mooned but I forgot to delist and someone bought my NFT for half the price of the floor!”

Grail

A grail is someone’s favorite NFT or NFT project. They believe it is a highly sought-after NFT and they’ll often brag about it like no tomorrow.

Example: “Wooshi is my grail… I am never selling my Wooshi World collection!”

Rekt

Getting Rekt means you took a hit and suffered heavy losses on an NFT project or coin. Generally, it means experiencing an uncomfortable outcome. You could get rekt if a project drops significantly in value. You could get publicly rekt on Twitter if you wrong the community in any way, etc.

Honey Pot

A trap! A honey pot is a more proactive and advanced scam from hackers that lure savvy NFT and crypto enthusiasts into a smart contract that appears to have a flaw that would allow a user to put in a certain amount of Ether and receive more in return.

P2E

Play-to-Earn is the latest development in the games industry. It’s a business model that embraces the concept of an open economy and provides financial benefits to all players who add value by contributing to the game world. The gamers can earn NFTs based on skill, investment and loyalty.

Boom! I see the wheels turning… You’re already coming up with crazy fun ideas of how to leverage this new technology, aren’t you?

If you want to brainstorm (I think the PC term is now ‘idea shower’, but it creeps me out), the PowerStation gang is happy to help you strategize your next move in this exciting space, while providing support, creatively and commercially.

To the moon…at Licensing Expo 2022 – keep a look out for us there!