Australian Market – a unique path to development

The BrandTrends Group has unveiled some major findings from its most recent research, and some key facts can be extracted when compared to previous years.

Australia is a continent, despite its size, since it is not politically connected to any other landmass and has unique geological, cultural, and political traits of its own. It is frequently referred to as the “island continent” and is the smallest of the seven continents in the globe. Additionally, it is the largest island on the planet!

Additionally, the country has a long history of entertainment, and Moose, the one and only toy company, is based in Melbourne.

Intense Competition in a Segmented, Fragmented Market

The 5 million children, aged up to 14, who are collectively familiar with over 211 entertainment brands is a testament to the vast exposure and brand competition in the market.

Each demographic shows awareness of roughly 72 of the 211 brands when evaluated by age and gender. The market is significantly structured, as evidenced by the distinct gender divide, with brands catering to boys, girls, younger children, and older children.

Although the market is well structured, only a small part of all brands – roughly 34% – are well known to both boys and girls. As a result, the market is also very fragmented.

Another striking element of the Australian licensing market is that girls aged 0 to 14 tend to be better served by targeted brands, since they specifically spontaneously cite 42% of all well-known brands. Girls typically have a broader knowledge of brands than boys do. With 1.7 times more distinct brands offered for girls than for boys, Australia has a far wider gap than any of the other countries BrandTrends tracks.

Where comic book superheroes rise, as in many other countries

Australia has followed the global trends where the key sub-brands and characters of the major comic book franchises, such as Marvel and DC Comics, are given priority.

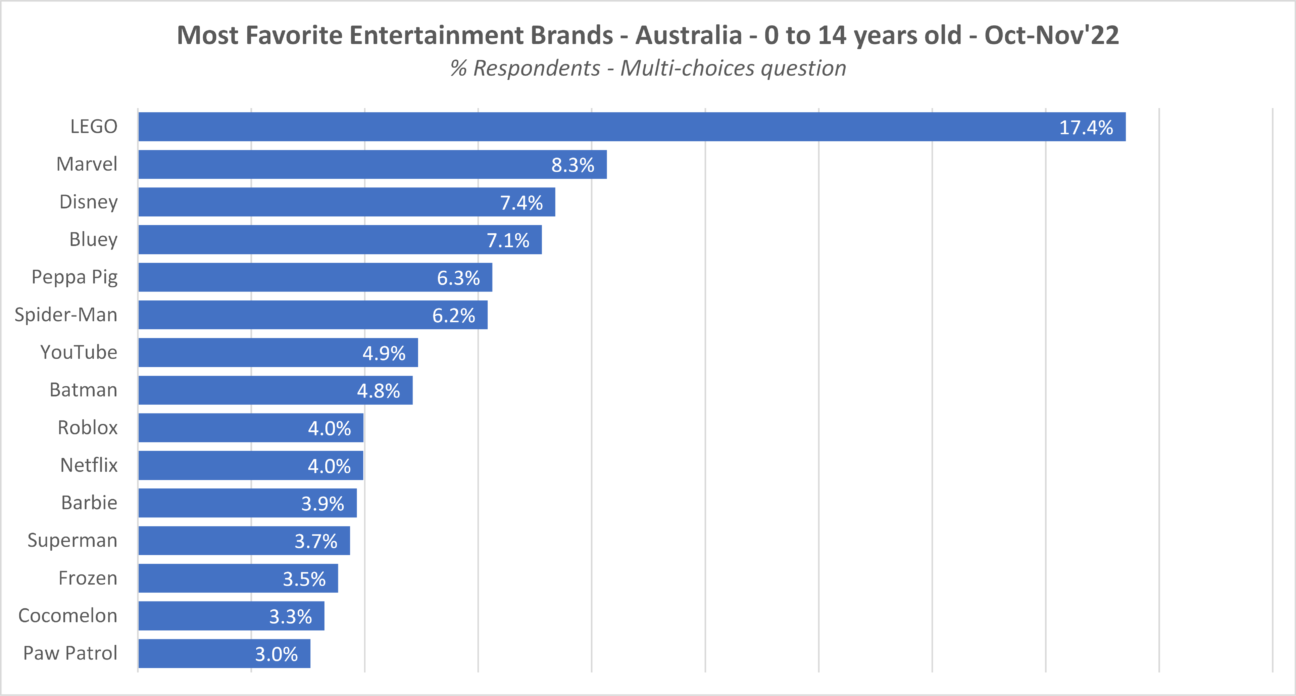

Marvel continues to hold an 8.3 percent share of the top mentions during the past four years. However, the brand initially dipped by 3 points during the pandemic period to return to its pre-pandemic level.

In contrast, the popularity of Avengers decreased from 2.7 percent in 2019 to 0.9 percent in 2022. The process of replacing the lower subbrands, such as Thor or the Avengers, is underway. In this Marvel universe, Spider-Man stands out as an important exception. This brand had significant growth among kids up to the age of 14, moving up to the sixth rank among the most well-liked brands among Australian kids.

A similar scenario occurred with DC Comics, though at a much slower rate, pushing the top franchise to reach 2.7% in 2022, at position twenty in the ranking.

Compared to other comparable markets, the Australian market has a number of interesting unique characteristics.

1. Strong Infant and preschool brands

First, the infant and preschool brand names are at the top of the market’s list of preferences. A clear indicator of this is the popularity of Bluey and Peppa Pig, Cocomelon, and Paw Patrol. And this isn’t because there aren’t enough brands in the market, which would force customers to concentrate on a small number of brands. Infants and preschoolers are familiar with just as many different brands as kids, teenagers, and even young adults. Therefore, the success of these brands is largely down to the way that Australians view families, which is quite encouraging for the markets.

2. The super power of LEGO

The second interesting aspect is the LEGO brand’s growing superpower, which has increased steadily over the past few years to 17.4% (+6.8 percentage points in 4 years), even though LEGO was already the top brand.

The fact that LEGO holds the largest leadership position for youngsters older than 7 years old is without debate. More than twice as many people favor LEGO over their direct competitors’ brands.

The preferred brands among preschoolers (ages 3 to 6) are still LEGO and Peppa Pig, though by a much smaller margin.

However, Bluey is unquestionably the only brand that infants in Australia like.

3. And the videogame brands are not successful…

Contrary to the general trend, videogames are not highly praised by children up to 14 years old in Australia.

Yes, the share of voice on Roblox increased, rising from 2.4% in 2019 to 4.0% in 2022. The only brand of that kind with this pattern is this one, though. For example, the preferred brand share in Australia was split by three for both Fortnite and Minecraft.

4. … but streaming sources are!

Netflix and YouTube both grew significantly in the past 4 years. As of Autumn 2022, they are ranked seventh and tenth, respectively, in terms of preferred entertainment brands among Australian children under the age of 14.

Ownership and Licensing Opportunities

In general, the market in Australia is flourishing for goods with an entertainment license. The variety of purchases has expanded in terms of product categories and quantity (more categories, more products within each category), but it has also increased in terms of the amounts of new purchasers who do not already own a licensed product. Additionally, their desire for these things must be sated. Overall, this indicates that the market for these products will grow over the next year.

The Australian market paves its unique path for expansion and development

Australia is a distinctive market for consumer packaged goods (CPG) products looking to secure entertainment licenses. With a strong presence of popular infant and preschool properties and a significant consumer demand for licensed products, this market has set its own unique trends. The enduring popularity of LEGO and the absence of strong success for video game brands in licensed products presents both challenges and opportunities for brands.

For established brands, the Australian market offers the chance to expand their brand portfolio, launch spin-off products, and introduce new items to the market. However, it also requires the development of innovative and fresh concepts to remain competitive in the face of established brands.

For brands with lower market penetration, it will require greater effort to break through and connect with consumers in this highly competitive market.