BrandTrends Group Identifies how to define a winning licensing strategy

The BrandTrends Group measures brand popularity and other key performance indicators for supporting brands in their efforts to drive growth.

Spring’23 BrandTrends reports unveil the top popular brands across the world. The data is measured through the popularity index, calculated by weighing four measures of awareness and attitudes (spontaneous awareness, aided awareness, brand attitudes, and top 3 favorites). The popularity index is unique and proprietary to BrandTrends. It has been developed for being predictive of the purchase intent and, as such, helps in defining the sales potential of IPs.

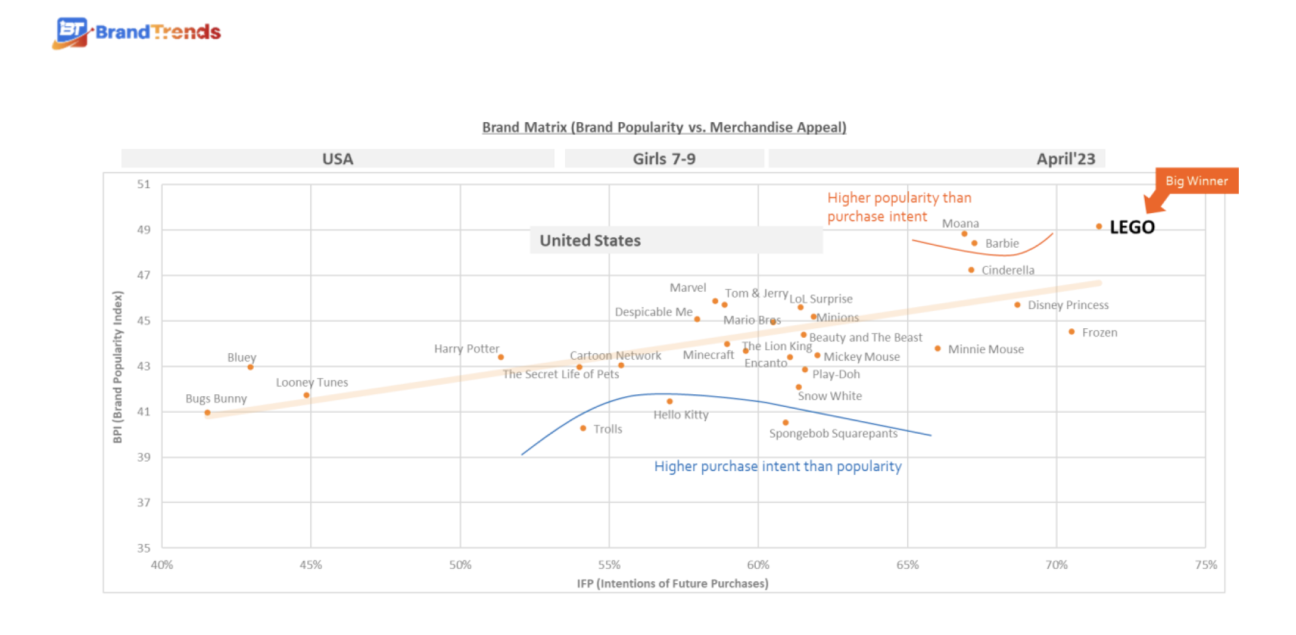

The brand matrix is one of the key BrandTrends analyses.

The matrix allows an easy overview of the market, providing different types of learnings.

1. What are the winning recipes for driving appeal

In this example, LEGO definitely appears as the big winner, ranking first, far above competitors, on both popularity and purchase intent. This great popularity is due to a mix of great presence in consumer’s minds (85% of awareness) and attitudes (#2 on liking and top favorite brands). And the brand could be even stronger: the higher level of popularity compared to purchase intent highlights the unexplored potential for the brand. Consumers are ready for an extended offer!

This is also the case, even on a lesser extent, for Moana (most liked) and Barbie (most salient in mind).

In the opposite, several brands reach higher purchase intent than popularity (Spongebob Squarepants, Hello Kitty and Trolls). By leveraging this appeal, those brands could drive more awareness, more liking and then higher popularity. Which would drive even more purchase intent!

2. How is the market structured and what is the competition

LEGO is the big winner, 5 brands reach a great mix of popularity and purchase intent (Moana, Barbie, Cinderella, Disney Princess, Frozen), then we can see a large bucket of brands reaching similar levels of performance, below the main players. This helps to understand how difficult it would be for a new comer to go through the clutter.

Another learning is about genderism and the fact that a large part of those top 30 brands (10 brands) appear in girls ranking, but not boy’s ones. Being strong among a target may be to the detriment of being strong on the overall market.