Mobile leads over consoles when it comes to IP collaborations

Data released as part of Layer’s new Collab Tracker shares new insights into the trends motivating IP collaborations within the games industry

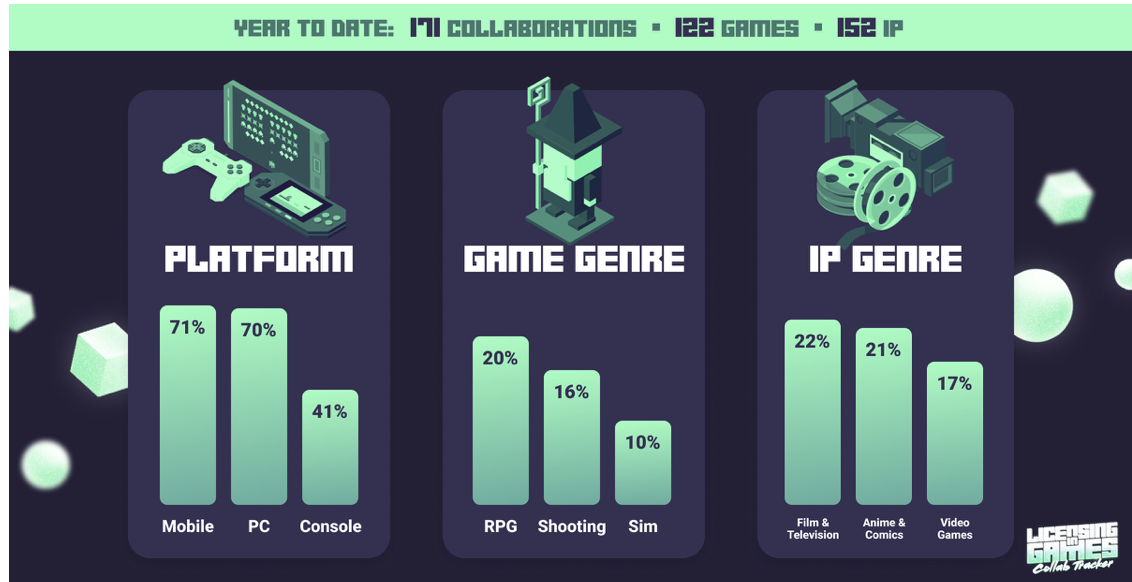

Layer Licensing, the online intellectual property (IP) marketplace, has launched the Licensing in Games Collab Tracker, a new database providing unparalleled insight into IP collaborations in video games. The database’s insights show that mobile games are leading the way in licensing collaborations, with 71% of IP integration occurring in mobile games.

It also reveals the most popular game genres and IPs for collaborations, providing much-needed insight into the top trends motivating IP collaborations within the games industry. In time, Layer will expand this database into an insights tool to further help clients track and understand the effectiveness of IP collaborations in the market.

- Almost three-quarters (71%) of IP integrations are in mobile games

- PC follows closely behind mobile at 70%

- Consoles show the least amount of IP collaborations, with only two-fifths appearing on the platform (41%)

- RPGs (20%) are the most popular game genre for IP collaborations, followed by shooters (16%) and simulation (10%). This trend is likely due to the flexibility and ease at which an IP can integrate with the genre, whether in the form of skins or timed quests/events

- Adventure and arcade games were joined last, with each category making up less than 1% of the total analysed

- When it comes to the most popular IP genres to feature in video games, film and TV lead the way (22%), followed closely by anime and comics (21%), with cross-collaborations with video game IP in third place (17%)

- Luxury and fashion comprise 3% of IP genres, while bands and musicians account for 6%

Mobile’s dominance highlights the importance of IP integrations to the mobile market, where studios and publishers constantly look at ways to attract and retain players. The use of IP integrations has delivered a clear ROI for mobile, with data from Sensor Tower showing IP games grossed $16B via in-app purchases in 2023

Rachit Moti, Founder & CEO at Layer, said: “Mobile game studios rely on user tracking to get the data they need for user acquisition (UA) campaigns, but growing privacy regulations such as Apple’s App Tracking Transparency (ATT) framework are making this more difficult. That’s why a growing number of game studios are licensing external IP into their live events to reach new audiences, broaden the appeal of their game and generate new revenue streams through the sale of cosmetic items based on the partner IP.

“Video game IP collaborations also lend themselves well to pop culture and geek trends, meaning license holders for movies, TV shows and anime have a wealth of opportunities to engage with a passionate audience of gamers. Our Collab Tracker makes identifying key partners for opportunities such as these easier than ever before, informing the industry and offering a resource for future integrations as the database expands to become the definitive insights tool for licensing deals in video games.”

IP collaborations and integrations within video games (also known as crossover events) are growing in popularity as they’re an effective way for game studios to boost player counts and generate new revenue streams from the sale of IP-based cosmetic items. Research from Newzoo’s 2023 IP and Brand Collaborations Report finds the average growth in DAU for all collaborations is 11%, and the growth in time spent is 7%.

New IP integrations will be added daily as the database grows to accommodate the 1000+ licensing deals that Layer has analyzed since 2022. The Collab Tracker launches in Beta with data on more than 170 IP integrations in video games between January and June 2024.